The Ultimate Guide To Frost Pllc

Table of ContentsFrost Pllc Fundamentals ExplainedFrost Pllc Can Be Fun For AnyoneMore About Frost PllcThe 8-Minute Rule for Frost PllcGetting The Frost Pllc To Work

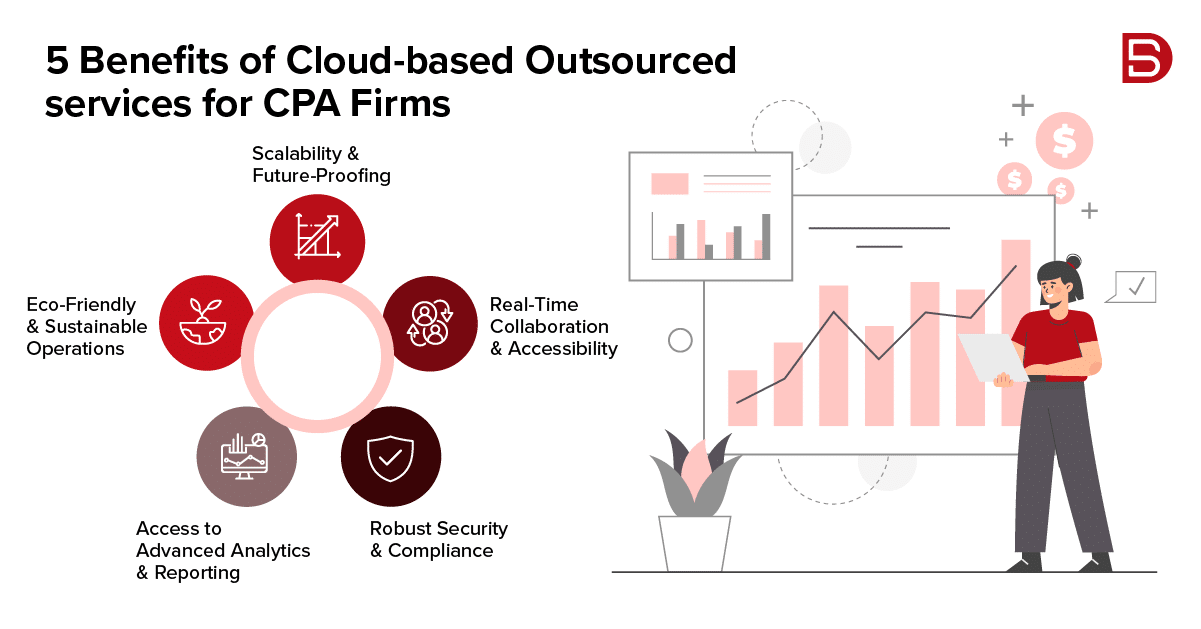

CPAs are amongst the most relied on careers, and forever reason. Not only do CPAs bring an unrivaled degree of understanding, experience and education and learning to the process of tax preparation and managing your cash, they are especially educated to be independent and objective in their work. A certified public accountant will certainly assist you secure your rate of interests, listen to and resolve your problems and, similarly crucial, give you assurance.In these defining moments, a CPA can supply more than a general accounting professional. They're your relied on consultant, guaranteeing your service stays monetarily healthy and balanced and legally safeguarded. Employing a regional certified public accountant company can favorably influence your service's monetary health and wellness and success. Here are five key benefits. A local CPA firm can assist minimize your business's tax problem while making certain compliance with all applicable tax obligation laws.

This development reflects our dedication to making a favorable effect in the lives of our clients. When you function with CMP, you come to be part of our family members.

Some Known Details About Frost Pllc

Jenifer Ogzewalla I have actually functioned with CMP for several years now, and I've actually valued their know-how and performance. When bookkeeping, they work around my timetable, and do all they can to preserve connection of workers on our audit. This saves me time and energy, which is vital to me. Charlotte Cantwell, Utah Festival Opera & Music Theatre For much more inspiring success stories and responses from service owners, click on this link and see exactly how we have actually made a distinction for services like your own.

Right here are some vital concerns to lead your choice: Check if the certified public accountant holds an active certificate. This guarantees that they have passed the needed exams and fulfill high ethical and professional standards, and it shows that they have the qualifications to manage your monetary issues sensibly. Validate if the CPA supplies solutions that line up with your business needs.

Little businesses have unique financial needs, and a Certified public accountant with relevant experience can offer more tailored advice. Ask regarding their experience in your industry or with services of your size to ensure they understand your particular difficulties.

Make clear how and when you can reach them, and if they supply routine updates or assessments. An easily view publisher site accessible and responsive certified public accountant will be vital for timely decision-making and assistance. Hiring a local CPA firm is more than just contracting out monetary tasksit's a wise financial investment in your company's future. At CMP, with offices in Salt Lake City, Logan, and St.

Frost Pllc - Questions

An accountant that has actually passed the certified public accountant examination can represent you before the IRS. Certified public accountants are licensed, accounting professionals. Certified public accountants may help themselves or as part of a firm, relying on the setup. The expense of tax obligation prep work might be lower for independent specialists, but their competence and capability may be much less.

All about Frost Pllc

Tackling this obligation can be a frustrating job, read this post here and doing something incorrect you can find out more can cost you both economically and reputationally (Frost PLLC). Full-service certified public accountant companies know with declaring needs to guarantee your business follow government and state regulations, in addition to those of financial institutions, investors, and others. You may need to report extra earnings, which may require you to submit a tax return for the very first time

Certified public accountants are the" huge weapons "of the audit industry and usually do not handle day-to-day accountancy jobs. Often, these various other types of accountants have specializeds across areas where having a CPA certificate isn't called for, such as monitoring accounting, not-for-profit bookkeeping, cost audit, federal government audit, or audit. As an outcome, using an accountancy services firm is often a far much better worth than employing a CERTIFIED PUBLIC ACCOUNTANT

firm to support your ongoing financial management monetaryAdministration

CPAs additionally have competence in developing and refining business plans and treatments and evaluation of the useful needs of staffing models. A well-connected Certified public accountant can take advantage of their network to aid the organization in different strategic and consulting roles, efficiently attaching the organization to the ideal candidate to fulfill their needs. Next time you're looking to fill up a board seat, consider reaching out to a Certified public accountant that can bring value to your organization in all the ways noted above.